Top U.S. economists have made calculations about the “pink tax,” which determines the difference in spending between women and men. In the United States, it is about $82,000 per woman over her lifetime.

It is because females are statistically more expensive to shop for than males. Their spending on food is significantly higher related to cosmetics, clothing, and household goods. However, sometimes women make mistakes in managing their finances, which the following tips will help avoid.

Table of Contents

Look at Life Realistically

Women don’t have much money to spare. They tend to think that they will find a high-paying job or a wealthy man in the future. Unfortunately, reality does not always coincide with dreams of a bright future. It often happens that a woman, by the age of 40, realizes that she has no alternative means of earning an income. In this case, being laid off from work leads to collapse. A woman loses her sole source of income and confidence in herself and her abilities.

Convert Your Annual Salary to Hourly: Salary Calculator

Attitude Towards Her Business

As a rule, it is difficult for women to separate creativity and business. They are not accustomed to the daily control of business management. The working mood depends mainly on the stand. Many young women do not keep track of the profitability of their business, are skeptical of brand promotion strategies, and rarely control their current expenses. Sometimes, this can lead to temporary cash-flow gaps, forcing them to turn to borrowed funds.

But, as practice shows, banks do not lend to business projects that raise doubts. But be that as it may, if you do not take a business seriously will go bust, and the investment will be unjustified. So if you need a $2500 loan asap, you can go to a lender.

It is also worth separating friendship and business. For example, A girl can lend her friend a large sum of money without the obligation to return the funds. But then, when the girlfriend’s business successfully develops, you do not always have to hope for the return of the debt or the receipt of dividends.

Proper Cost-Sharing

Women rarely follow the rule of separating personal and business expenses. If one card is used to pay for office rent, budget deductions, dinner at a restaurant, and cosmetic procedures, correctly calculating business and personal expenses will not work. Moreover, such a financial allocation can cause problems with the tax authorities. The negative consequences of such negligence can lead to unforeseen costs and the loss of business.

Excessive Financial Tutelage

You shouldn’t spend all the money you earn on your children. Often, a mother’s love is blinding. Women can forget about themselves when it comes to a child. For example, a mother may walk around in old clothes when the children have better smartphones. Some women save everything for themselves, only to put their children in private kindergartens or schools. The most exciting thing is that, in the future, not all children will appreciate their mother’s behavior.

As a result, the woman cannot ensure a decent future for herself. She does not realize that the children will grow up and that her financial situation could become dire.

Humanity and Heroism are Not Always Appropriate

It is characteristic of a woman to be impressionable. But unfortunately, this quality often becomes the cause of unforeseen expenses. As soon as things go up, the girl quite often decides to help orphanages, relatives, friends. Of course, doing unselfish acts is good, but you need to control yourself. Sometimes it is better to invest in business or self-development.

When You Are with the Wrong Man

Quite often, strong women who are already successful in business do not pay attention to the wealth of their partners. Many are content that their chosen one helps at home and looks after the children. Such a humble gentleman can not become a worthy party for a confident girl.

In the long run, such relationships are doomed. A man eventually loses his credibility in the eyes of a woman, but the worst thing is that he will consider his chosen one as a source of income.

There are other cases. A man can earn good money, but he does not respect a woman. She clings to her chosen one, as she has no means to exist and sees no prospects.

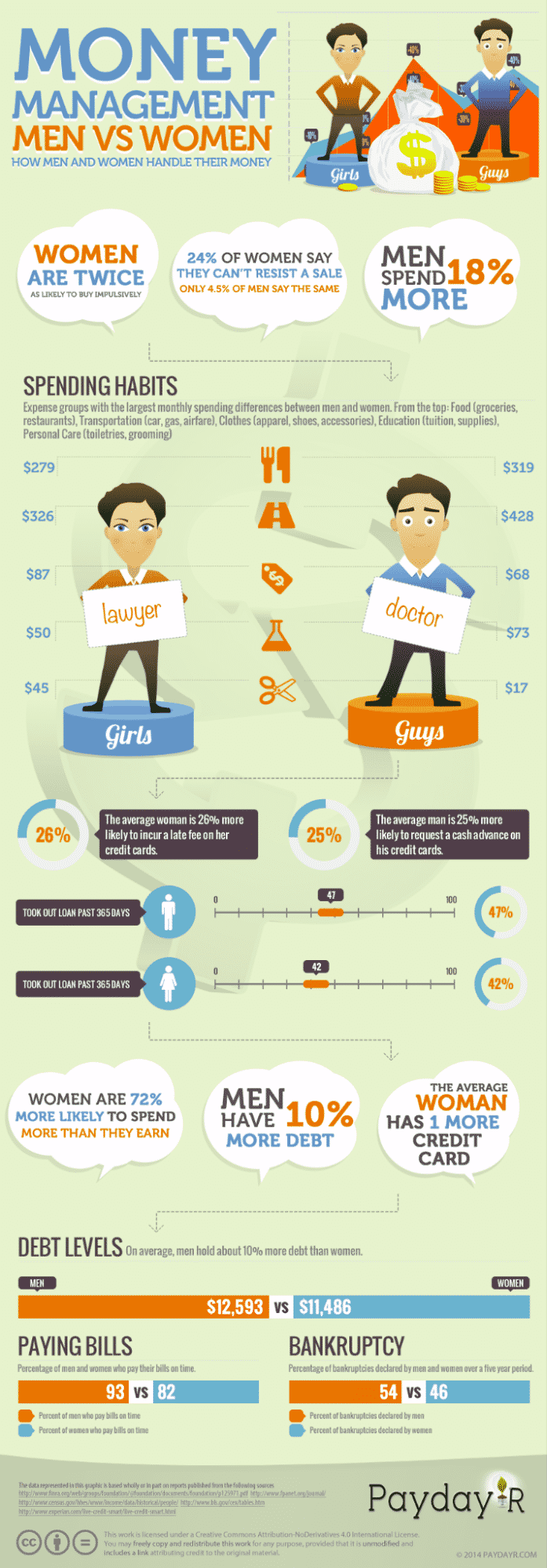

Impulsive Shopping

Women need to take a more responsible approach to change their closets or making more meaningful purchases. For example, it is not always right to buy another pair of shoes just because there is no such pair in the collection.

It’s essential to make the right purchases, to be able to allocate funds for necessary things, rest, and care, and to try not to go over the budget.

11 Reasons Why Women Should Learn About Finance

Can you answer precisely what your family’s income is? Do you have savings? How much debt do you have (mortgages, car loans, credit cards, etc.)? What would happen to your debts if you lost your spouse tomorrow? How much and what does your family spend per month (loans, rent, food, sports, kids, medicine, insurance, parents, etc.)? What 3-5-10 and 20-year financial goals does your family have? If you don’t know the answers to most of these questions, you are putting not only your future at risk but your children’s as well.

Here are 11 reasons women need to learn about finances and take an active role in managing them:

- Women live longer than men. That difference is usually more than ten years. So it’s only a matter of time, but women will have to manage their finances sooner or later after their husbands leave. Statistically, it’s 9 out of 10 women who will outlive their spouse. So it’s better to start learning early, at a relaxed pace, than when a million problems come crashing down on you.

- Loss of capacity for work or the sudden death of a spouse. Statistically, one in four men in their 20s will become disabled before retirement. Unfortunately, that could be your husband.

- Women are more likely than men to quit their jobs to take care of sick parents and other family members.

- Divorce, children, divided in half! The statistics are devastating. 50–55% of marriages fall apart for a variety of reasons. And if you are a homemaker and the court leaves the children to you, imagine what it would be like to be left without the full support of your husband, with no job, no financial cushion, and no idea how to run your financial affairs.

- Women spend more than medicine men. So it’s essential to have a reserve (for old age included), take care of your health and nutrition every day (I write about this all the time), have insurance (health and life), and try to raise grateful and caring children (also a whole science), etc.

- Women earn less than men. Statistically, by 25% to 30%This is because women work less, as they are more likely than men to give up their careers to raise children and take care of loved ones. Returning to their careers, women often accept lower-paying jobs with more flexible schedules. Therefore, women need to manage money more effectively

- Women are more afraid than men to talk about finances, even with friends, family, and spouses, considering these conversations too personal. Because of this, they often find themselves out of (financial) business, in life, and their careers.

- Whoever makes (more) money controls it. Wrong! This attitude has worked for centuries in many cultures but is now obsolete. Instead, finances should be managed by the best financial manager of the two spouses, regardless of who earns a more significant sum. The spouse who is better at saving, keeping track of money, controlling emotions (of both spouses), and investing money is referred to as a “good manager.”

- Women are better money-savers than men. Subconsciously, they understand more vulnerability. As a result, women’s sense of security is more vital than men’s. Having a financial cushion is one of the most critical steps to economic well-being and family security.

- The husband left, and debts and problems remain. However, losing a spouse (death, divorce, disability) does not mean that debts and problems go with him. For example, if you and your husband did not insure your loans, you (the woman) would be responsible for paying the mortgage, car loan, credit cards, or other debts after he dies.

- Never “go into” a car loan or mortgage as a co-borrower without your spouse’s life and disability insurance.

Conclusion

Being a wonderful mother, a wonderful wife, taking care of your parents, making money, going to sports, taking care of yourself, and dealing with a million family issues is a lot! Therefore, women, including non-working women, deserve to know a lot, if not everything, about family finances.