Credit monitoring is a system which tracks your credit record, and therefore financial actions, and notifies you when any unusual transactions go through. Its basic purpose is to help you spot fraud or any transactions that you have not put through yourself. But, there’s more to credit monitoring. It can provide you with the tools to improve your credit score, helping you secure a personal loan or mortgage in the future.

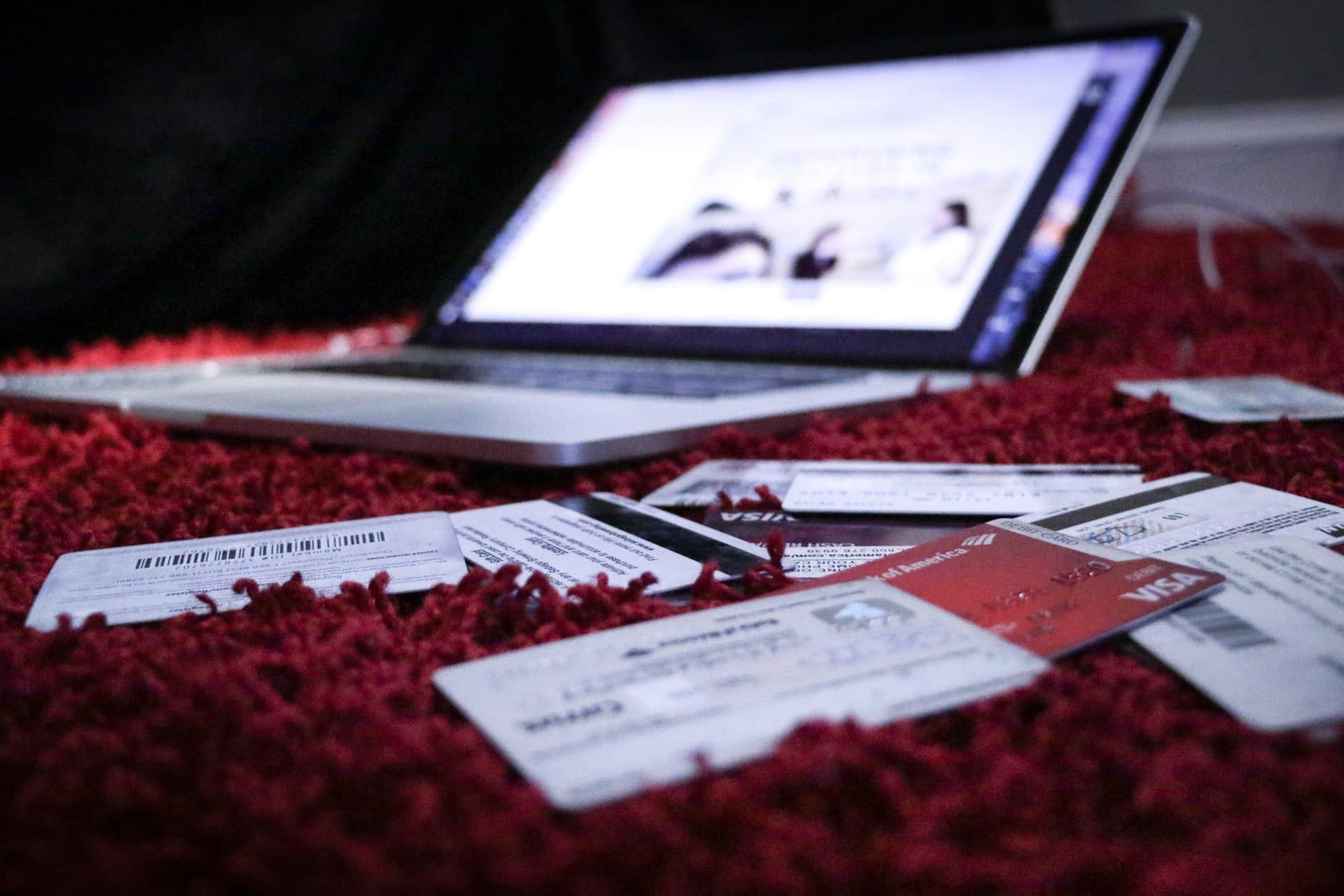

In 2020, there were around 1.4 million reports of identity fraud in the US, representing an almost 100% increase on the previous year’s rates. By using a credit monitoring tool, you can protect yourself.

Table of Contents

How Does Credit Monitoring Work?

Credit monitoring services such as Experian IdentityWorks tracks your credit reports for new activity and then lets you know if any suspicious activity takes place. For instance, it may alert you to the fact that you’ve applied for a new loan or credit card. If that was you, then this service acts as a reminder. If it wasn’t you, it has alerted you to potential fraud, and allows you to take action quickly.

These services typically cost money, but could be worth it. If you can’t afford to pay for a service, you could monitor your own credit through regularly checking your credit record.

What Is a Credit Record?

In short, a credit record shows all of your financial actions. It will show when you have taken out a loan, applied for a credit card, and repaid loans and taxes. It is built from nuggets of information provided by banks, credit unions, credit card companies, collection agencies, and governmental organizations.

From your credit record, you will be allocated a credit score. This is a number between 300 and 850, and you are aiming to have as high a score as possible. The higher your score, the stronger your financial history, and the more attractive you are to lenders.

Apart From Being a Safety Tool, Why Is Credit Monitoring Beneficial?

Credit monitoring allows you to see how your actions impact your credit score, and encourages you to only make financial moves that are in your interest. For example, if you apply for loan after loan, your credit monitoring service will notify you, and show you how that is affecting your score – which, most likely, will be negative.

This allows you to build up a stronger credit profile.

Why Do I Need a Strong Credit Record?

When you apply for any form of credit, your credit record is a lender’s port of call when deciding whether to lend to you. For instance, if you need a new credit card, the provider will assess your history and see whether you are a reliable borrower who can – and does – typically pay back their debts. Similarly, if you apply for a payday loan, having a score above 600 will help you attain a loan with lower interest. However, if your credit monitoring hasn’t quite paid off yet, there are plenty of options for funding. You could be eligible for a no credit check loan, allowing you to take out a loan despite a rocky financial past.